Also see:

- Exploring Amex Serve for free money and handy uses after April 16th

- Bye, REDbird; Hello again, Serve

- Seriously tempted by the 75,000 point Citi Hilton Visa offer

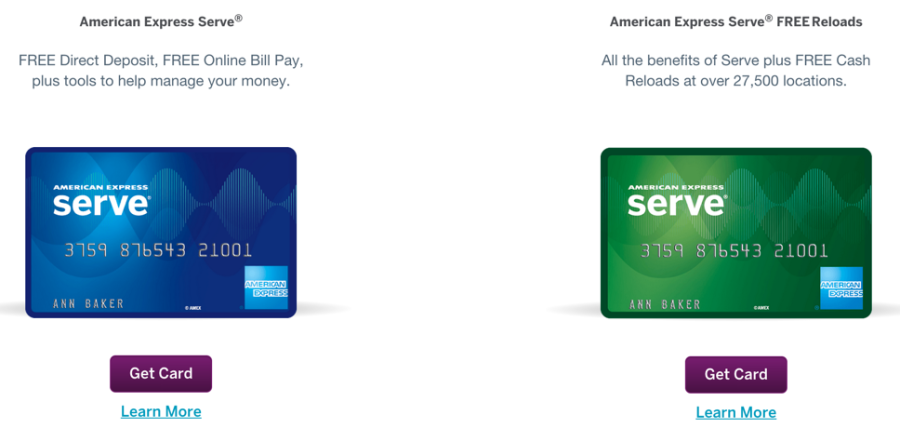

It looks like Serve has a new prepaid debit card – and it’s already on the front page of their website.

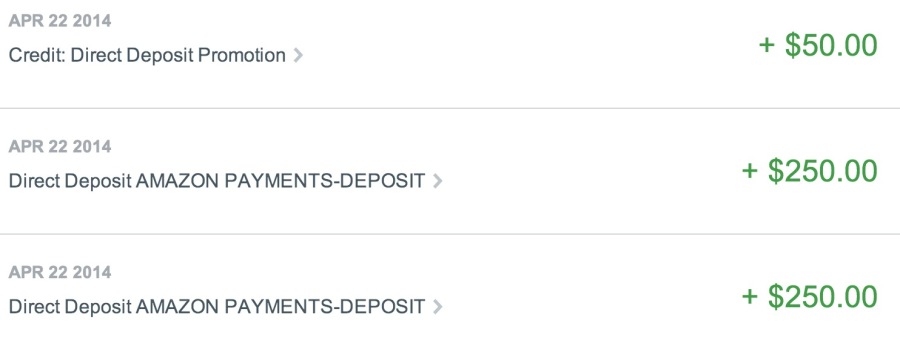

AMEX is apparently splitting the “Old Blue Serve” into 2 separate products.

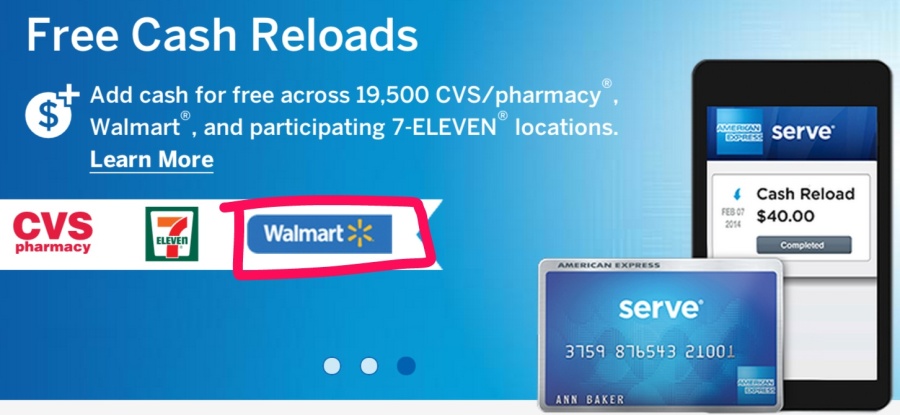

And you can reload the “New Green Serve” at CVS, Family Dollar, Walmart, and 7-Eleven.

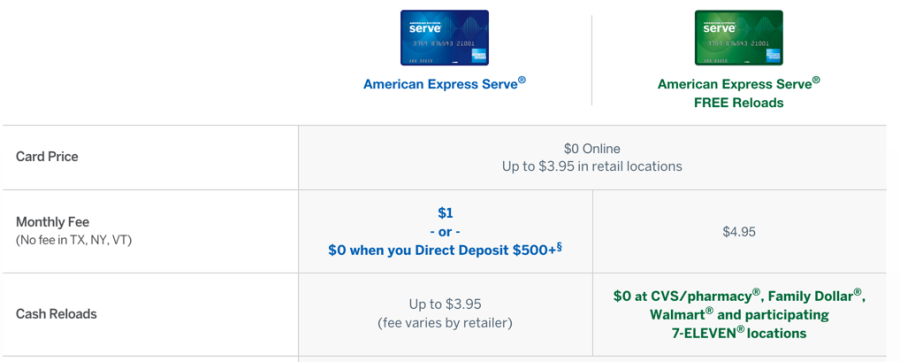

And New Green Serve has a $4.95 monthly fee – but not if you’re in Texas, New York, or Vermont.

I’m not sure if you can have both products at the same time – or what the split means for Old Blue Serve, if anything.

Aside from the new monthly fee, and the free cash reloads, it looks like the 2 products are exactly the same.

It would be really awesome if CVS took credit cards for the “cash reloads.”

I’d take my new Hilton credit card for a joyride (as it’s one of the only credit cards left that still earns points at drugstores – 3X Hilton points @ $1,000 a month reload limit would equal 36,000 points annually. That’s good for a few Hilton Category 2 hotel stays!).

All of the other terms and conditions – reload limits, ATM fees, etc. are identical.

After switching from Bluebird to Serve then to REDbird, then back to Serve again, I’ll keep my eye on this as it seems like AMEX is still rolling this out. This would be a great way (and convenient) way to manufacture some spend and pay bills you can’t ordinarily pay with a credit card. Especially in the barren wasteland of New York City.

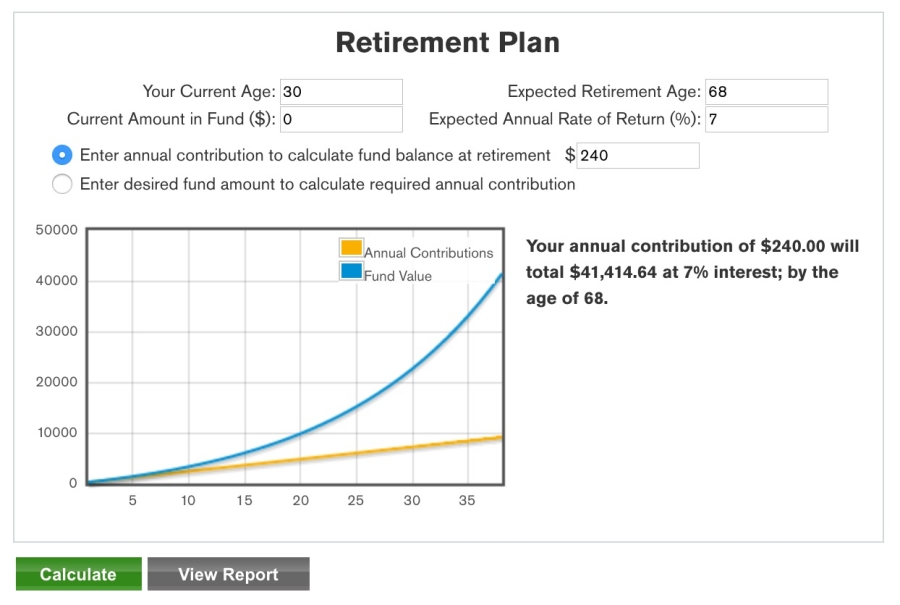

Although if you can’t, I’m perfectly fine collecting my free $240 a year with the Fidelity AMEX.

Mark this one as developing…