UPDATE: One or more of these offers are no longer available. Click here to see the latest deals!

0% APR intro offers are common, especially for purchases. And you can usually transfer a balance from another card – but you’ll pay fees in the form of a percentage of the amount you transfer. The more you transfer = higher fee.

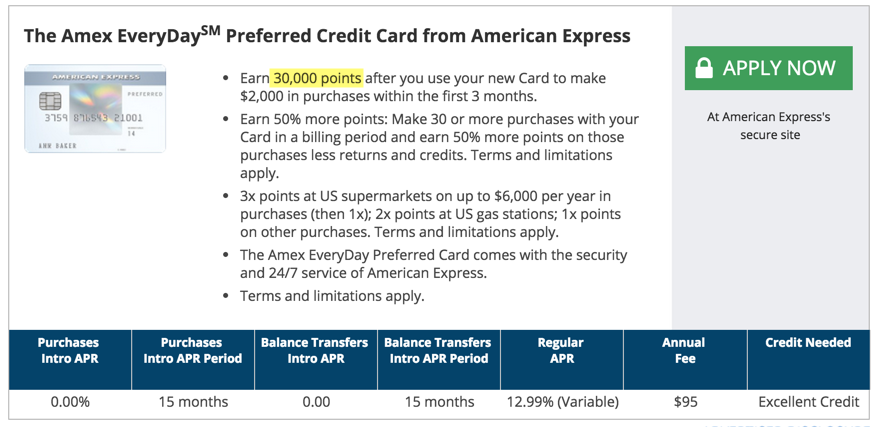

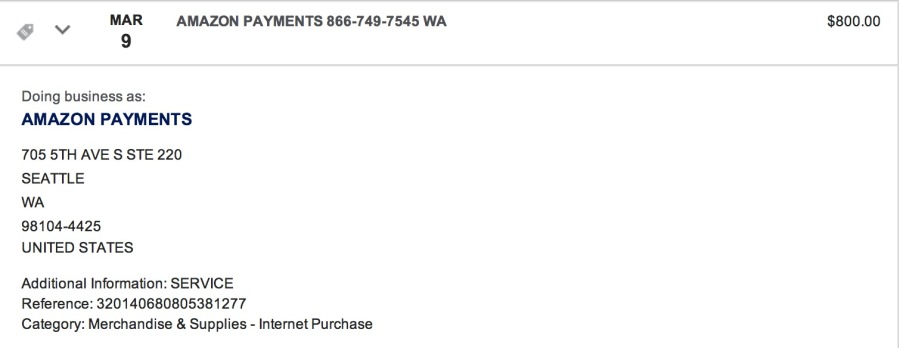

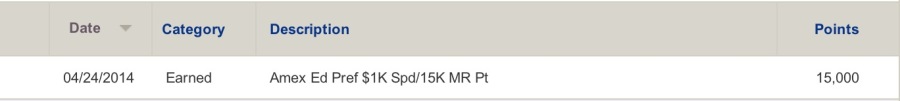

So when I saw a deal for 15 months of 0% interest on purchases including NO fees on balance transfers, that caught my attention. Then I realized it was with an actually useful Amex card – with a decent welcome bonus. It’s the Amex EveryDay card – learn more here.

Offers like these aren’t as exciting as getting tens of thousands of bonus points. But they can give you a lot of breathing room – especially if you need to plan for a big purchase, or catch up to avoid paying hundreds in interest fees. In this case, for well over a year.

I’ve taken advantage of similar offers in the past. And this one would be a great way to consolidate some balances. Especially if you’re over 5/24.