Update: Not sure what’s going on but I see the 24-month language on some application pages. I’m wrong and nothing has changed. I got excited and jumped. Going to close this for now. Sorry for the false alarm!

Just a quick post.

Citi has been limiting card sign-up bonuses per family of “brands” to every 24 months – with a clock that resets if you open OR close an account within that family. The 3 brands are:

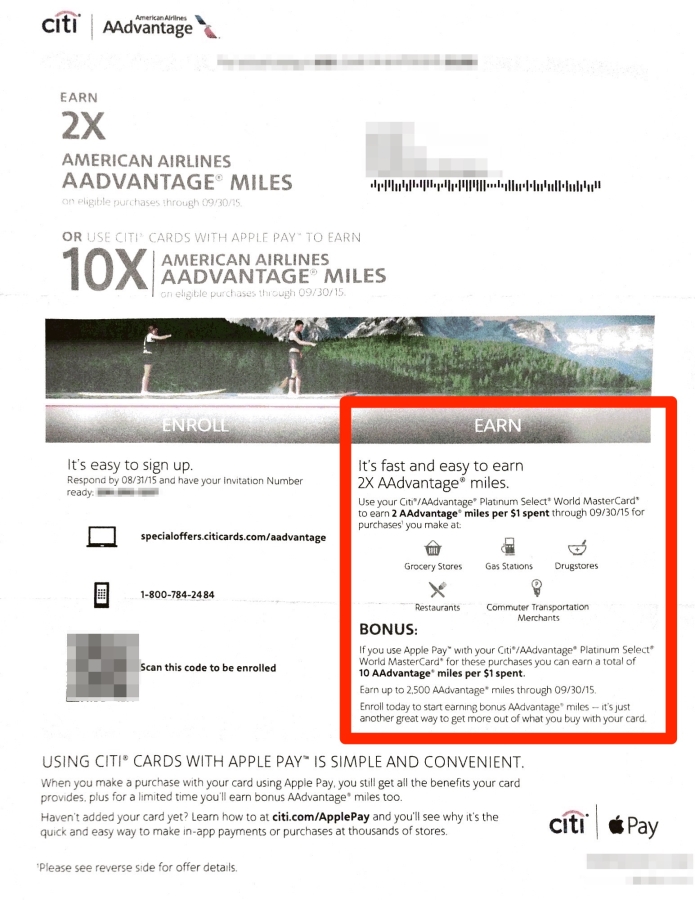

- American Airlines

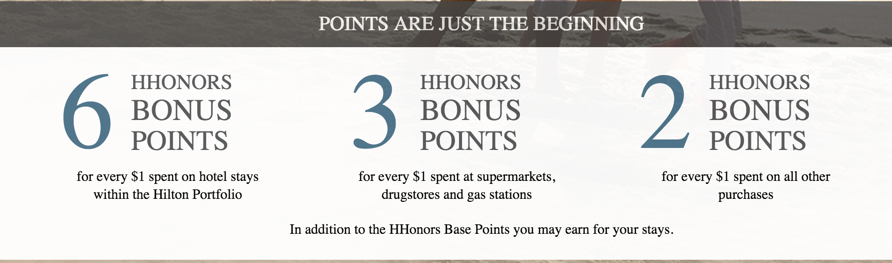

- Hilton

- ThankYou points

So for example, if you opened or closed the Citi Hilton Reserve within the previous 24 months, you could NOT get the sign-up offer on the Citi Hilton no annual fee card. Period.

But it looks like that restriction has shifted:

Now it says, “This offer valid for new accounts only.”