Also see:

- Yes! Just got the Barclaycard Arrival!

- One Year(ish) Later: The Barclaycard Arrival. Keep or toss?

- Seeking kindreds on the Barclaycard Travel Community

So torn. Always kinda have been.

The Barclaycard Arrival Plus. I’ve always wondered what it was, in the sense that it was a bit of an enigma.

I got this card in May 2013. The annual fee was waived for the 1st year.

I got a retention offer the 2nd year.

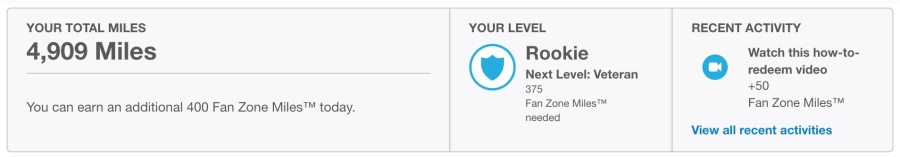

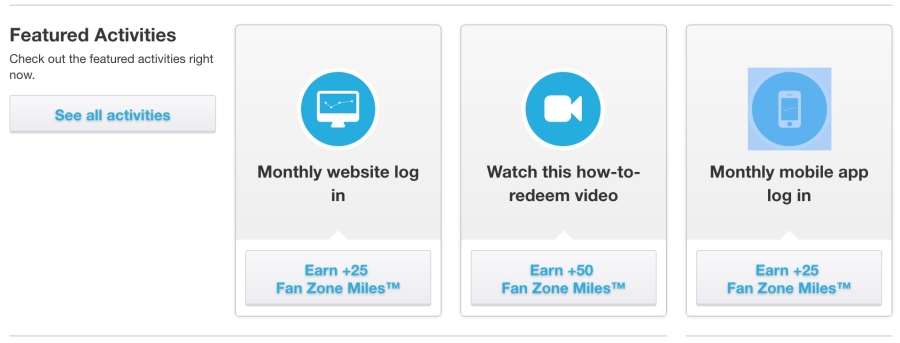

I just paid the $89 annual fee about a month ago. I want to cancel this card. But it has 1 good use left in it…

Is is worth it?