AA account post-hack is an update to this post.

My AAdvantage account was brutally hacked back in July. Someone got my login info and used nearly all the miles for an award flight.

They also used my email to sign me up for literally thousands of emails lists—I’m still unsubscribing from them to this day. It was a clever move, because the emails from American Airlines could’ve easily fallen through the cracks. I guess that’s what they were hoping for.

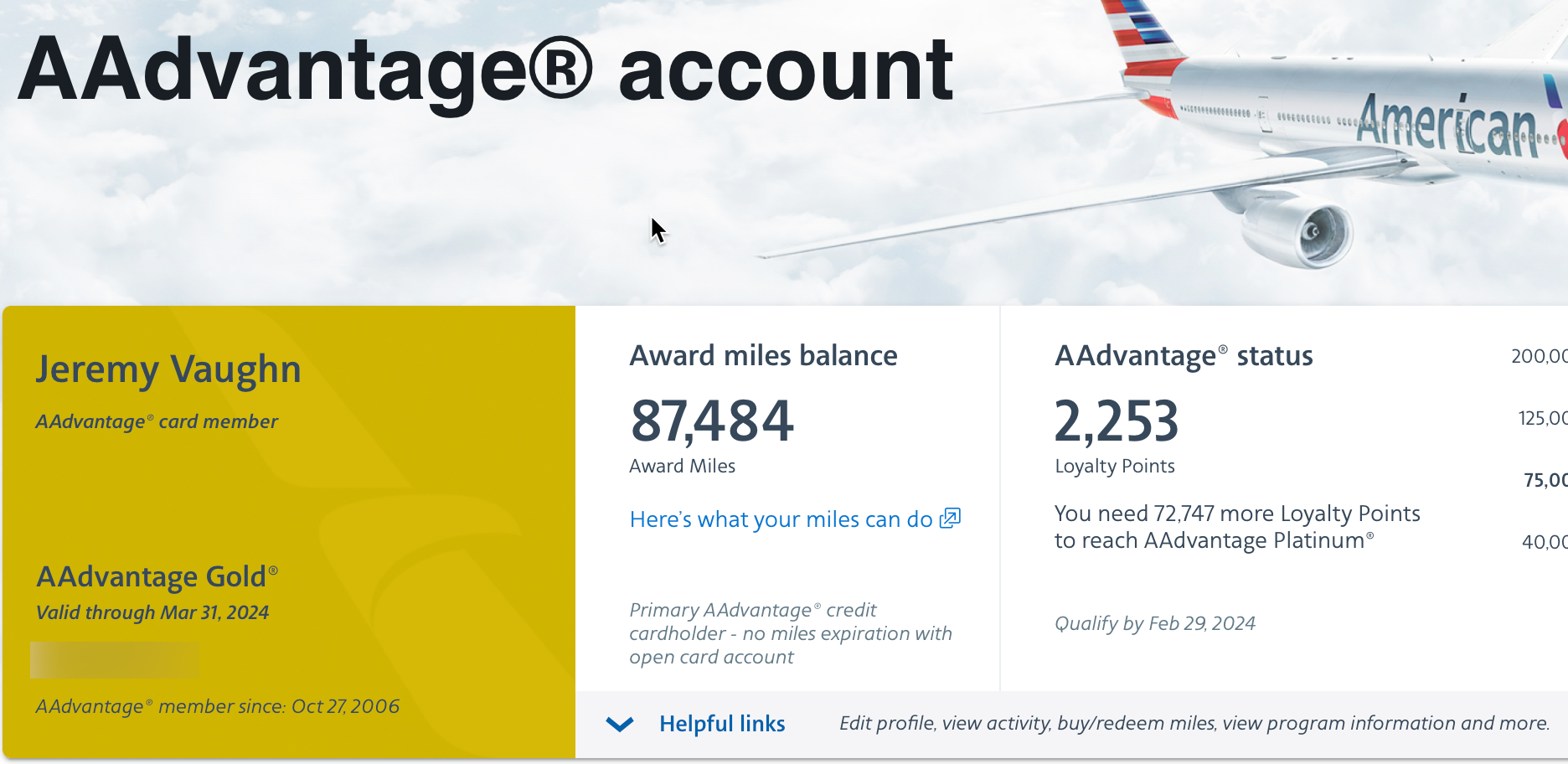

Keeping the “Since 2006” was a nice touch

Stuff is mostly back. All my activity ported over, along with Loyalty Points, elite status… even the date I joined AAdvantage. ✈️

I basically didn’t have an account for ~2 months. And I’m still discovering all the things that don’t quite work the way they should.

I’ve spent hours and hours on hold and talking to various American staff. It looks like more calls are needed.

Starting over isn’t easy following a hack.